The Definitive Guide for Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration - An OverviewRumored Buzz on Eb5 Investment ImmigrationThe Only Guide to Eb5 Investment ImmigrationEverything about Eb5 Investment ImmigrationEb5 Investment Immigration Things To Know Before You Buy

While we strive to provide precise and current web content, it should not be taken into consideration legal suggestions. Immigration legislations and laws are subject to change, and private conditions can vary commonly. For individualized assistance and lawful guidance concerning your specific migration circumstance, we highly recommend talking to a qualified immigration attorney who can give you with customized support and make certain compliance with present legislations and laws.

Citizenship, with financial investment. Currently, since March 15, 2022, the amount of investment is $800,000 (in Targeted Work Locations and Rural Locations) and $1,050,000 in other places (non-TEA areas). Congress has actually accepted these quantities for the following 5 years beginning March 15, 2022.

To get approved for the EB-5 Visa, Financiers need to develop 10 permanent united state jobs within 2 years from the date of their complete financial investment. EB5 Investment Immigration. This EB-5 Visa Requirement ensures that financial investments add directly to the united state job market. This applies whether the tasks are developed straight by the company or indirectly under sponsorship of a marked EB-5 Regional Facility like EB5 United

Facts About Eb5 Investment Immigration Revealed

These jobs are figured out via versions that use inputs such as advancement prices (e.g., construction and devices expenditures) or annual profits created by recurring procedures. In contrast, under the standalone, or direct, EB-5 Program, just direct, permanent W-2 worker settings within the business might be counted. An essential danger of counting solely on direct workers is that team decreases as a result of market conditions can result in not enough permanent placements, possibly bring about USCIS rejection of the capitalist's application if the work production requirement is not satisfied.

The economic version then forecasts the variety of direct work the brand-new organization is likely to create based on its expected earnings. Indirect jobs calculated with financial versions describes employment generated in industries that supply the goods or services to the business directly associated with the project. These jobs are created as an outcome of the increased need for items, products, or solutions that sustain business's procedures.

Eb5 Investment Immigration Fundamentals Explained

An employment-based fifth preference group (EB-5) investment visa gives a technique of coming to be a long-term U.S. citizen for international site nationals intending to spend resources in the United States. In order to look for this permit, a foreign financier has to invest $1.8 million (or $900,000 in a Regional Center within a "Targeted Work Location") and create or preserve at the very least 10 permanent jobs for United States employees (leaving out the investor and their immediate family members).

This measure has actually been a significant success. Today, 95% of all EB-5 resources is elevated and important link invested by Regional Centers. Given that the 2008 economic dilemma, accessibility to capital has actually been tightened and local budgets proceed to deal with significant deficiencies. In several regions, EB-5 financial investments have loaded the funding gap, giving a new, essential resource of funding for local financial growth projects that revitalize neighborhoods, create and support tasks, infrastructure, and services.

The Eb5 Investment Immigration PDFs

workers. Additionally, the Congressional Budget Plan Office (CBO) racked up the program as earnings neutral, with administrative expenses spent for by applicant costs. EB5 Investment Immigration. More than 25 nations, consisting of Australia and the United Kingdom, use similar programs to draw in foreign financial investments. The American program is extra rigorous than numerous others, calling for considerable threat for investors in terms of both their financial investment and immigration standing.

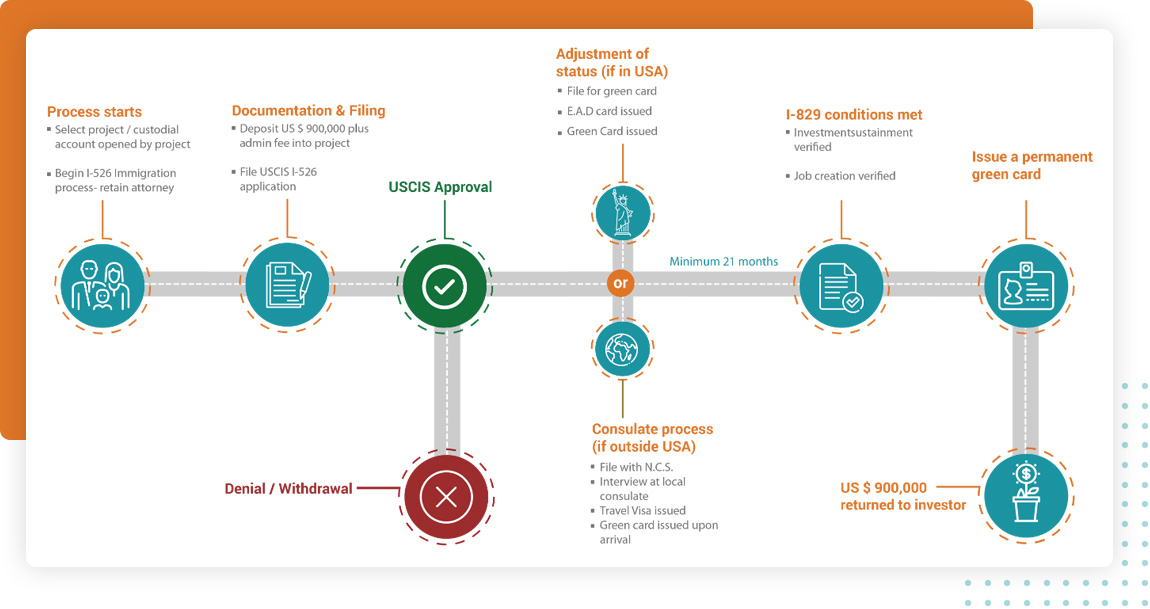

Households and individuals that look for to move to the United States on why not look here a long-term basis can use for the EB-5 Immigrant Investor Program. The United States Citizenship and Immigration Provider (U.S.C.I.S.) established out various needs to obtain permanent residency with the EB-5 visa program.: The first action is to discover a qualifying financial investment opportunity.

Once the opportunity has been determined, the financier has to make the financial investment and send an I-526 application to the united state Citizenship and Immigration Services (USCIS). This petition should include evidence of the investment, such as bank statements, purchase contracts, and service strategies. The USCIS will certainly examine the I-526 application and either accept it or request additional evidence.

Not known Facts About Eb5 Investment Immigration

The investor has to look for conditional residency by submitting an I-485 petition. This request needs to be submitted within 6 months of the I-526 approval and must include proof that the financial investment was made and that it has actually produced at least 10 permanent tasks for U.S. employees. The USCIS will assess the I-485 request and either approve it or demand extra evidence.